The latest ranking of pharmaceutical companies

2019-04-15 09:56:51

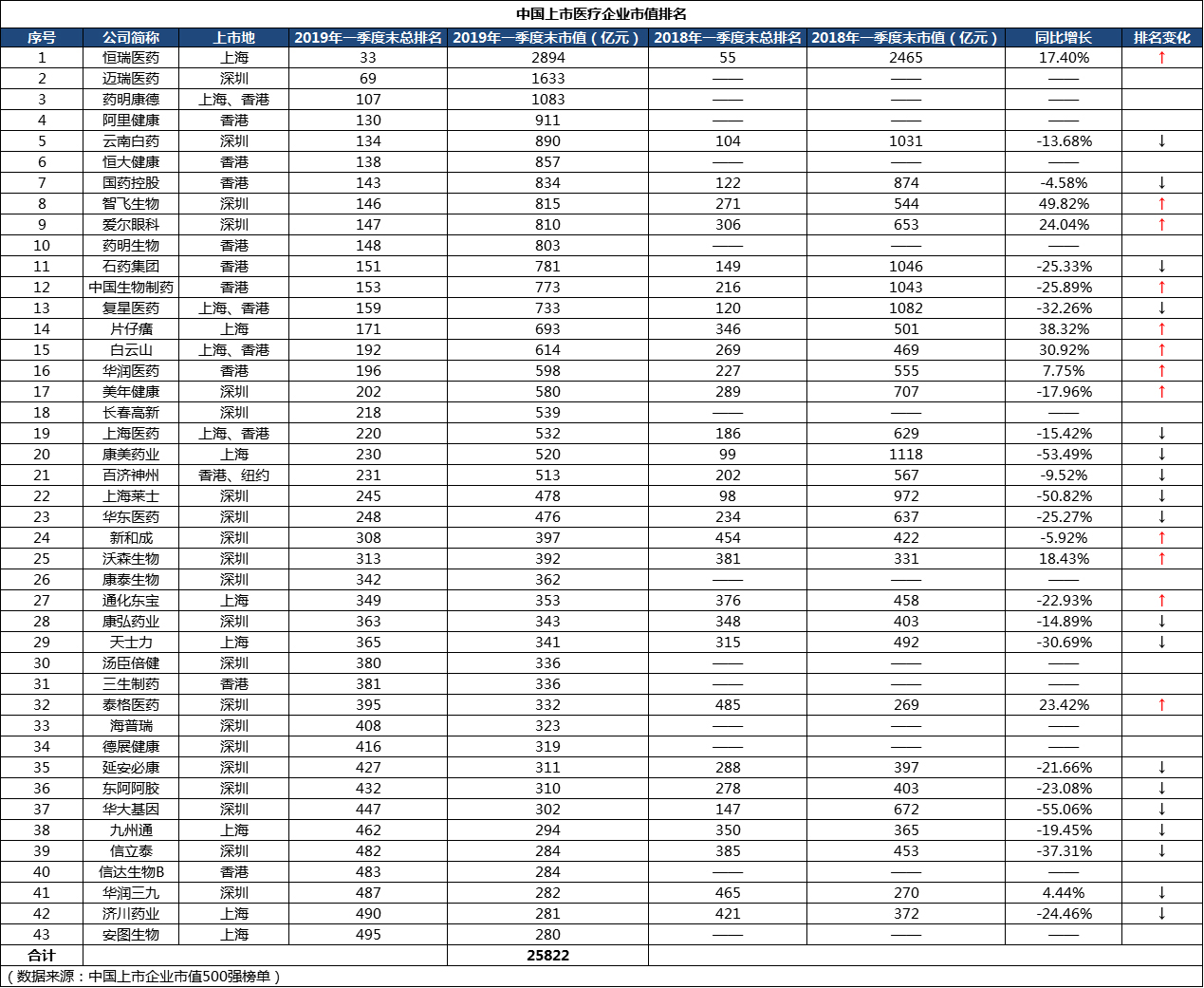

Recently, Wind released the latest list of "China's Top 500 Listed Companies by Market Value". According to the list, as of the end of the first quarter of 2019, a total of 43 pharmaceutical-related companies were shortlisted for the top 500, with a total market value of 2582.2 billion yuan, compared with 2131.5 billion yuan in the same period last year, a year-on-year increase of 21.14%, accounting for 3% of the total market value of all top 500 companies, while the same period last year was 4%.

Although there has been an overall increase compared to last year, it is still obvious that the pharmaceutical industry market is undergoing a dramatic restructuring. On the one hand, the number of companies with a market value of hundreds of billions has shrunk severely; on the other hand, 12 companies that were on the list last year have disappeared this year.

Throughout 2018, with strong performance growth and the country's support for innovative drugs, the stock prices of pharmaceutical companies, especially some innovative pharmaceutical companies, have hit new highs. After June, there is only one word: fall. Especially after the iconic 4+7 centralized procurement, the market value of the entire pharmaceutical stock evaporated 300 billion in just a few days.

Only three listed companies with a market value of 100 billion yuan remain

According to the list, as of the end of the first quarter of 2019, there were only three Chinese pharmaceutical-related companies with a market value of more than 100 billion yuan, namely Hengrui Medicine (289.4 billion yuan), Mindray Medicine (163.3 billion yuan), and WuXi AppTec (108.3 billion yuan). Among them, the three companies have pharmaceutical, equipment, CRO and other new drug research and development services as their core businesses. In 2018, all of them were dominated by pharmaceutical companies.

According to Hengrui Medicine's 2018 annual report, the company achieved operating income of 17.418 billion yuan, an increase of 25.89% over the same period last year; net profit attributable to the parent company's owners was 4.066 billion yuan, an increase of 26.39% over the same period last year; net profit attributable to the company's shareholders after deducting non-recurring gains and losses was 3.803 billion yuan, an increase of 22.60% over the same period last year.

Hengrui Medicine's annual report attributed its performance growth to the following two aspects:

First, the harvest of innovative achievements. The gradual harvest of innovative achievements has played a driving role in the company's performance growth.

Second, the company's product structure optimization. With the adjustment of the company's product structure, the company's non-anti-tumor drug products represented by surgical anesthesia, contrast agents and special infusions have gradually expanded their markets in their respective treatment fields and continued to maintain a steady growth trend.

Previously, Mindray Medical also released its 2018 annual performance forecast, with revenue of 13.0-14.4 billion yuan, an increase of 16.34%-28.87% over the same period last year.

In WuXi AppTec's annual report, during the reporting period, the company achieved operating income of 9.6 billion yuan, a year-on-year increase of 23.80%; since most of the company's business income comes from overseas and is denominated in US dollars, if calculated based on the average exchange rate of the same period last year, the company's operating income increased by 25.41% over last year.

Today, the basic situation of the industry gives innovative drugs more policy advantages. Innovative drug research and development has industry characteristics such as high investment, long cycle, and high risk. Therefore, under the dual squeeze of increased R&D costs and patent cliffs, pharmaceutical companies are expected to promote R&D projects more through external R&D service agencies.

In addition, 5 companies fell out of the 100 billion market value team, namely Yunnan Baiyao, Shijiazhuang Pharmaceutical Group, China Biopharmaceuticals, Fosun Pharma, and Kangmei Pharmaceutical. Among them, Kangmei Pharmaceutical had the largest decline, with its market value falling from 111.8 billion yuan to 52 billion yuan, a year-on-year decrease of 53.49%.

Kangmei Pharmaceutical has been plagued by negative news and troubles in the past year. Since the fourth quarter of 2018, it has been exposed to black swan events such as high-frequency and high-value financing, high deposits and interest-bearing liabilities, suspected information disclosure violations, and investigation by the China Securities Regulatory Commission. The stock price has plummeted by more than 70% in the past year. In particular, from October 16 to 23, 2018, in just 5 trading days, the company's stock price fell by 40.36%.

11 companies including Lepu and Tongrentang dropped out of the list

Compared with last year, 12 pharmaceutical listed companies dropped out of the list: Lepu Medical, Tongrentang, Kelun Pharmaceutical, Livzon Group, Kangzhe Pharmaceutical, Buchang Pharmaceutical, GenScript Biotech, Huahai Pharmaceutical, Hualan Biotech, Yifan Pharmaceutical, and Beda Pharmaceutical.

4+7 is one of the reasons that cannot be ignored. Take Lepu Medical as an example. Since the announcement of the results of the "4+70% volume-based procurement", Lepu Medical has been hitting the daily limit for three consecutive trading days, with a cumulative market value of 15.61 billion yuan evaporated.

The winning results show that the two products that Lepu Medical participated in the bidding, clopidogrel and atorvastatin, were not selected. However, the price of clopidogrel, which was won by its competitor Xinlitai, was reduced by more than 70%.

Xueqiu's original column shows that after the introduction of the 4+7 volume-based procurement policy, Lepu Medical, which was the most injured, fell by 38.6%, including three consecutive days of daily limit; Hengrui Medicine, the largest pharmaceutical leader in terms of market value, fell by 25%, Huahai Pharmaceutical, the big winner of centralized procurement, fell by 23.9%, and Hualan Bio, a blood product that was less affected, fell by 20%, and Zhifei Bio, a vaccine, fell by 16.8%.

Huahai Pharmaceutical's stock price fell to the limit due to the valsartan incident, and its market value evaporated by more than 5 billion. The incident started when Huahai Pharmaceutical discovered and detected the unknown impurity N-nitrosodimethylamine (NDMA) during the optimization and evaluation of the production process of valsartan raw materials. As a result, the incident continued to ferment, and Huahai Pharmaceutical continued to recall related products in the domestic and US markets.

13 new faces

This year, 43 pharmaceutical companies were selected for the "Top 500 Chinese Listed Companies by Market Value" list, one more than last year. According to statistics, the 12 companies that fell out of the list are mainly traditional pharmaceutical companies, while the 13 new companies are mostly distributed in the fields of biotechnology and medical devices, including: Mindray Pharmaceuticals, WuXi AppTec, Alibaba Health, Evergrande Health, WuXi Biologics, Kangtai Biological, By-Health, Sansure Pharmaceuticals, Hepalink, Dezhan Health, Changchun High-Tech, Innovent Biologics, and Antu Bio.

Amid the changes in the Hong Kong Stock Exchange's policies, biotech companies have been continuously favored in 2018. Currently, there are 7 unprofitable biotech companies listed on the Hong Kong stock market, and Zhifei Bio and BeiGene have been shortlisted in the top 300 by market value for two consecutive years.

The newly shortlisted WuXi Biologics ranks 10th among pharmaceutical companies with a market value of 80.3 billion yuan. According to the annual report released earlier, in 2018, WuXi Biologics' revenue was RMB 2.535 billion, a year-on-year increase of 56.6%; net profit was RMB 631 million, 249.6% of the same period last year, and North America is still its largest market.

It is expected that by 2021, the company's planned biopharmaceutical industrial bases in China, Ireland, Singapore and the United States will have a total production capacity of approximately 220,000 liters.

According to incomplete statistics, the rankings of most pharmaceutical companies are declining; only 10 pharmaceutical companies, including Hengrui Medicine, Zhifei Bio, Aier Eye Hospital, China Biopharmaceuticals, Pien Tze Huang, Baiyunshan, China Resources Pharmaceutical, Meinian Health, Xinhecheng, and Tonghua Dongbao, are showing an upward trend in ranking.

China Merchants Securities believes that in 2019, China's biopharmaceuticals will usher in a watershed. The Shanghai Stock Exchange announced the listing rules of the Science and Technology Innovation Board. More biopharmaceutical companies going to the Science and Technology Innovation Board for listing will be able to better reflect and anchor their value. In addition, the adjustment of the medical insurance catalog in 2019 will benefit more biopharmaceutical companies, unlike the previous adjustment that mainly benefited generic drugs.